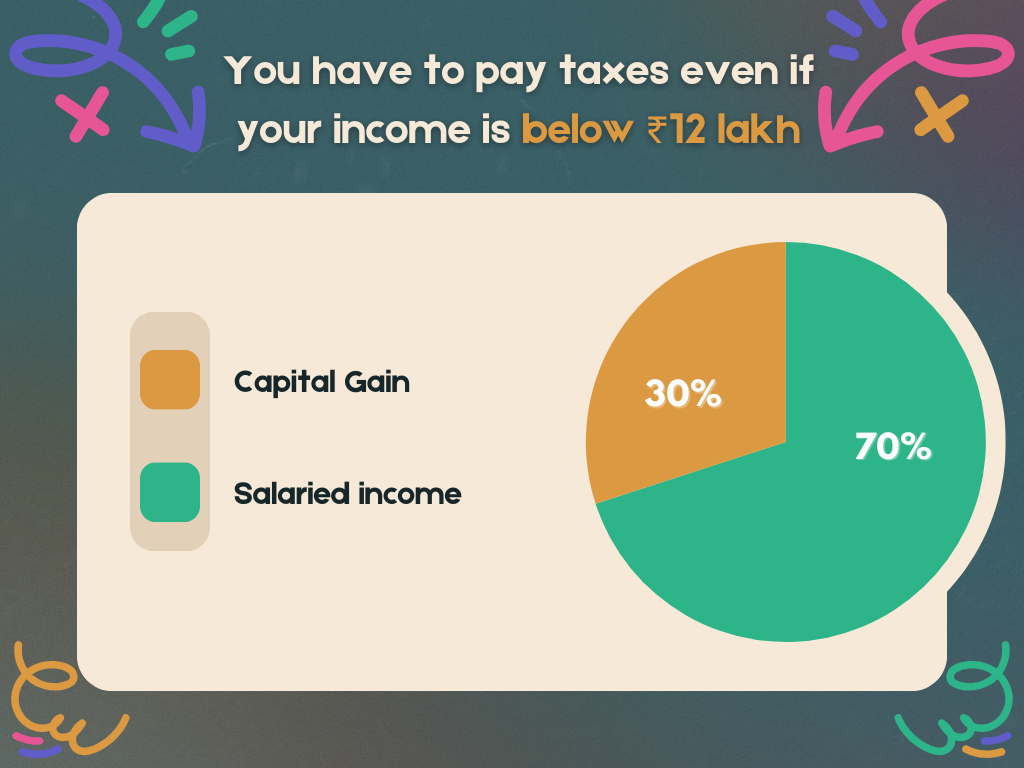

You must pay taxes even if your income is below ₹12 lakh.

The real twist comes after the “but”

So yes, if you earn less than ₹12 lakh a year, you’re in the tax-free club.

But, not all income is treated the same.

Let’s say your salary is ₹10 lakh, comfortably under the ₹12 lakh exemption limit.

But if you make an extra ₹3 lakh from capital gains, maybe from selling stocks or property, which many do.

That extra income doesn’t get the same tax-free treatment.

The capital gains portion is taxed separately, based on the standard tax slabs.

So the ₹12 lakh exemption mainly applies to your regular salary or primary income.

But earnings from capital gains, dividends, interest, rental income, or even certain business profits follow different tax rules.

This setup mainly benefits salaried individuals.

Not non-salary income.

Honestly, I didn’t see the full picture at first.

Now that I’m just starting to learn about the stock market and investing, I’m left wondering,

“Should I focus on making profits, or start setting aside money for taxes before I even make any?”

Awesome https://shorturl.at/2breu

Good https://t.ly/tndaA

Good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2

Awesome https://is.gd/N1ikS2

Very good https://is.gd/N1ikS2